Facebook’s announcement of plans to launch a digital currency, earlier this summer, set in motion a full-blown turf war in global finance. The statement from Silicon Valley is that the digital currency is supplementary to bringing the world closer together through social networks.

Facebook’s announcement of plans to launch a digital currency, earlier this summer, set in motion a full-blown turf war in global finance. The statement from Silicon Valley is that the digital currency is supplementary to bringing the world closer together through social networks.

Facebook has two significant advantages over traditional banks. Not only can it process transactions at a much lower cost, but also it already has billions of users on its platforms. Talk about an untapped market.

However, living up to that mission has been stymied by several factors. For one, the Libra cryptocurrency project is in the middle of existential threats from world leaders and central banks whose primary concerns are Libra’s potential to be used for clandestine financial activities. The nature of Libra and the scale on which it will operate makes it the perfect mule for money laundering. Stakeholders are also worried about the threat Libra poses to global financial stability and data privacy abuse, which culminates in economic privatization by some of the largest companies in the world.

As Mark Zuckerberg tries to quell this crisis, several high-profile companies that collaborated in the project, known as the Libra Association, have pulled out in a manner that is typical of the need for self-preservation. These included PayPal, eBay, Visa, and MasterCard. The backing by these financial giants gives Libra its credibility and is perhaps the biggest threat to centralized economies. The remaining financial firms and mainstream companies in this project are just not enough to stop Libra’s lose in credibility.

The last straw that broke Libra’s back was when the G7 group of the world’s most powerful nations warned that digital currencies such as Libra pose challenges for competition and antitrust policies and should not be allowed to launch until every regulatory concern has been addressed.

The last straw that broke Libra’s back was when the G7 group of the world’s most powerful nations warned that digital currencies such as Libra pose challenges for competition and antitrust policies and should not be allowed to launch until every regulatory concern has been addressed.

As the US House of Representatives mounts pressure on Libra, Cambridge Analytica is still fresh in stakeholders’ minds. Politicians, activists and central banks have raised questions over data privacy and Facebook’s possible monopoly of a huge database of personal information. With these questions, there is no doubt that Facebook has lost bragging rights to build a digital currency, especially when it has failed to protect sensitive data in the Cambridge Analytica scandal.

Although the Bank of England is open-minded about new technology for financial transactions, it has been vocal about the need for worldwide heavy regulation of Libra. It has also maintained that Libra would need to meet the highest standards of fiat regulation – if Facebook’s dream would survive.

Although Libra would have high-tech competitive advantages that would make it quicker and cheaper, building a payment system that meets central banks’ regulations will no doubt drive the project into the ground in no time. It would be the perfect fall from grace to grass. With 2.45 billion active Facebook users, Libra could literally shift the global financial system overnight.

This has caused governments and central banks around the world to worry about the loss in control of their monetary policy if Libra handles significant financial activities. The potential shift poses a threat to national sovereignty. Besides, the “deploy—test—improve” approach typical of Silicon Valley companies is incompatible with a financial project as big as Libra.

If Facebook can satisfy politicians, central bankers, and activists over their concerns, no doubt, financial exclusion especially in developing and authoritarian countries can be history overnight. In addition, the ability of the digital currency to bypass expensive cross-border payments will save individuals and small-scale businesses money and time – thus improving personal profit margins and national GDPs exponentially.

Year: 2019

The Risk Factor: Bitcoin vs. Gold Investment

Cryptocurrency is volatile – more than stocks, bonds, or any other familiar investment. The value of

bitcoin can go up by 25% in one hour, and it could crash in the next hour or so.

The value of bitcoin is stabilizing, give some time, and we should see a stable price chart. However,

this hasn’t been the case so far. The digital currency is relatively new. With all its hype, bitcoin

hasn’t shown the signs of being a “security asset.” You cannot trust bitcoin for the next financial

crisis.

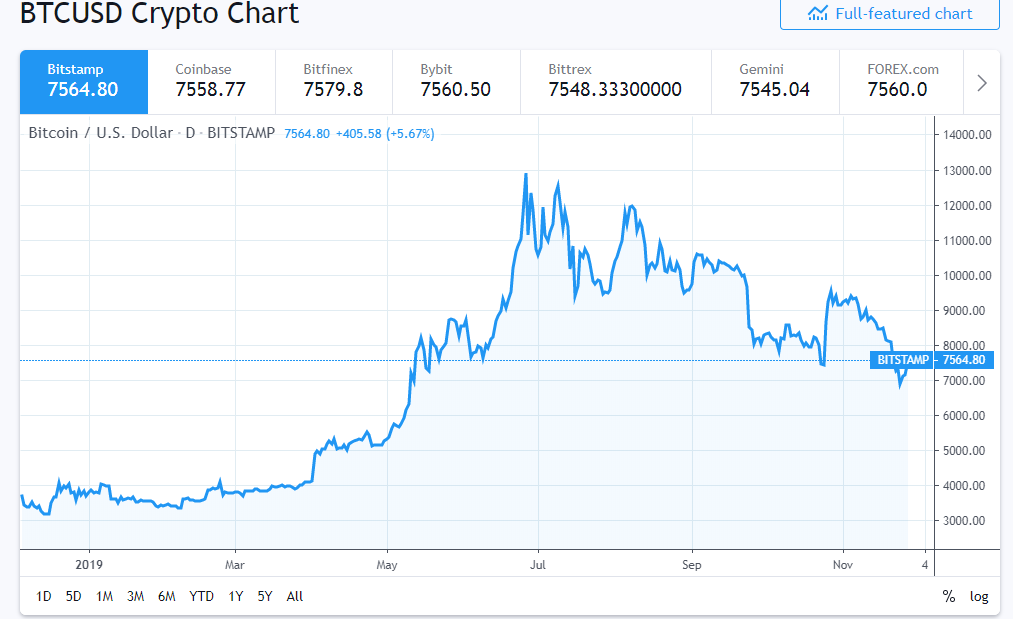

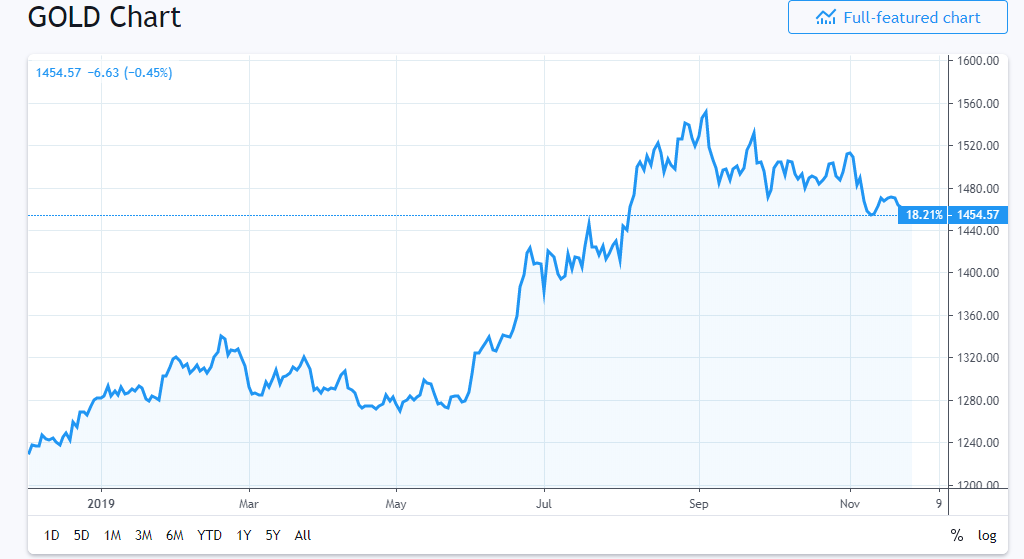

Reviewing the Data

Gold price rises according to a decrease in the US dollar. That’s a trend we have seen for a long time.

Compared to that, bitcoin has moved positively, and negatively with gold charts. Consider the

recent depreciation in Chinese Yuan. The stock market fell, and gold went to an all-time high in

2019 ($1,510). Following the same pattern, bitcoin went to the all-month high to $12,325 from

$9,900.

However, the charts have also moved in different directions. Until (Nov. 2018) bitcoin was being

traded at $6,000. Prices went down significantly, and by the mid of December, bitcoin was selling at

$3,000. Interestingly, in the same timeframe, gold moved from $1,200 to $1,300.

Bitcoin and gold don’t have same pricing patterns. One thing that gives bitcoin an edge is that it is a

payment network, and that alone has a considerable value. However, the numbers are changing,

and we still have to see whether bitcoin can be ‘safe haven.’

Resources:

https://www.tradingview.com/symbols/BTCUSD/

https://www.coindesk.com/bitcoin-and-gold-prices-diverge-again-extending-5-month-correlation

https://www.tradingview.com/symbols/TVC-GOLD/

https://www.coindesk.com/bitcoin-outshines-gold-amid-risk-aversion-in-financial-markets

Find profitable Divergences with TradingView

If you haven’t done yet – head over to TradingView and create an account.

Divergences are a great way to find out if the current trend is about to reverse – this very short video will show you how to manually find Divergences with TradingView.

If you need a more advanced way to detect Divergences, sou should check my Product: AutoDivergence

AutoDivergence Updates

In the past couple of months, I took the time to work on my existing products and I made some major and minor improvements.

The most exciting thing is that I finally managed to merge all my divergence-based products into one single Study/ Strategy: AutoDivergence.

This strategy now includes JeddingenDivergence v4, CCIDivergence and MACDDivergence. I also implemented a “classic visualization”, so you can use AutoDivergence in the same way a lot of you have been using CCIDivergence for manual technical analysis.

But of course all the other products have been improved too and all of them include detailed documentation on how to set up and use the Strategies.

And last but not least: I lowered the monthly subscription fees: all of my products are available for only $9.90/ month with monthly cancellation possible – no Strings attached!

have a look at this short video about AutoDivergence: Video on AutoDivergence