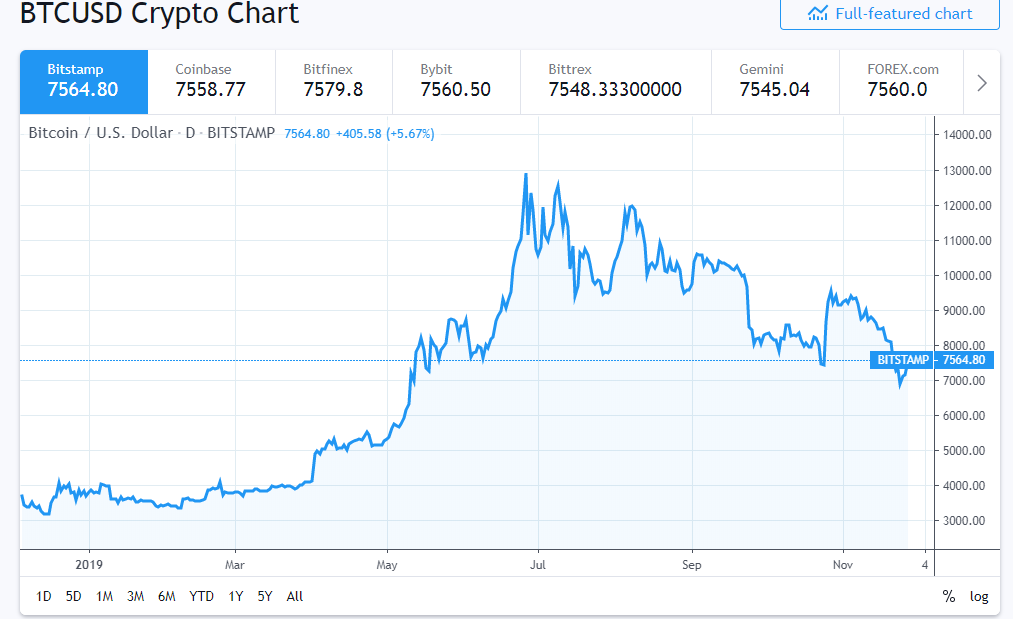

Cryptocurrency is volatile – more than stocks, bonds, or any other familiar investment. The value of

bitcoin can go up by 25% in one hour, and it could crash in the next hour or so.

The value of bitcoin is stabilizing, give some time, and we should see a stable price chart. However,

this hasn’t been the case so far. The digital currency is relatively new. With all its hype, bitcoin

hasn’t shown the signs of being a “security asset.” You cannot trust bitcoin for the next financial

crisis.

Reviewing the Data

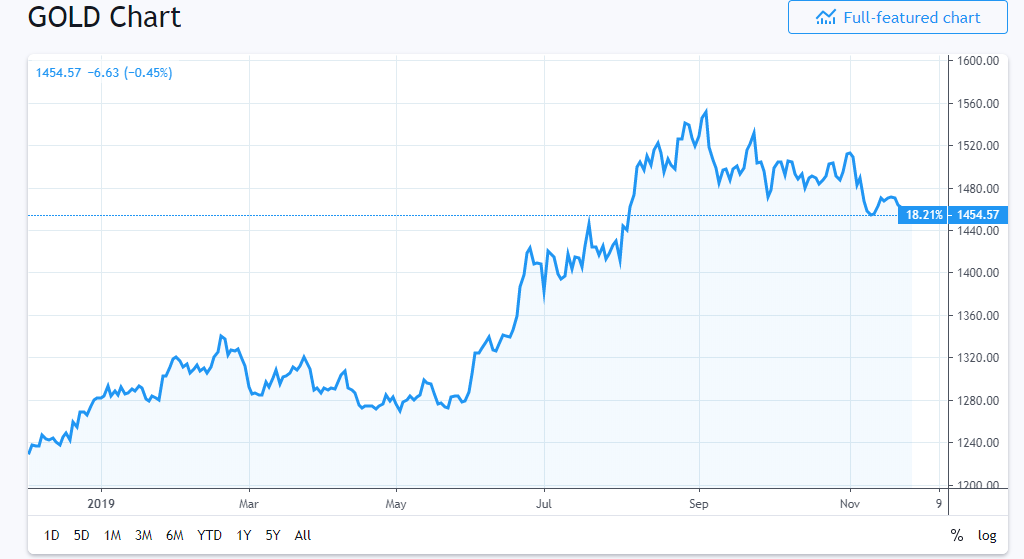

Gold price rises according to a decrease in the US dollar. That’s a trend we have seen for a long time.

Compared to that, bitcoin has moved positively, and negatively with gold charts. Consider the

recent depreciation in Chinese Yuan. The stock market fell, and gold went to an all-time high in

2019 ($1,510). Following the same pattern, bitcoin went to the all-month high to $12,325 from

$9,900.

However, the charts have also moved in different directions. Until (Nov. 2018) bitcoin was being

traded at $6,000. Prices went down significantly, and by the mid of December, bitcoin was selling at

$3,000. Interestingly, in the same timeframe, gold moved from $1,200 to $1,300.

Bitcoin and gold don’t have same pricing patterns. One thing that gives bitcoin an edge is that it is a

payment network, and that alone has a considerable value. However, the numbers are changing,

and we still have to see whether bitcoin can be ‘safe haven.’

Resources:

https://www.tradingview.com/symbols/BTCUSD/

https://www.coindesk.com/bitcoin-and-gold-prices-diverge-again-extending-5-month-correlation

https://www.tradingview.com/symbols/TVC-GOLD/

https://www.coindesk.com/bitcoin-outshines-gold-amid-risk-aversion-in-financial-markets